Problem Solved

From

Behavior Gap to

Behavior Gain

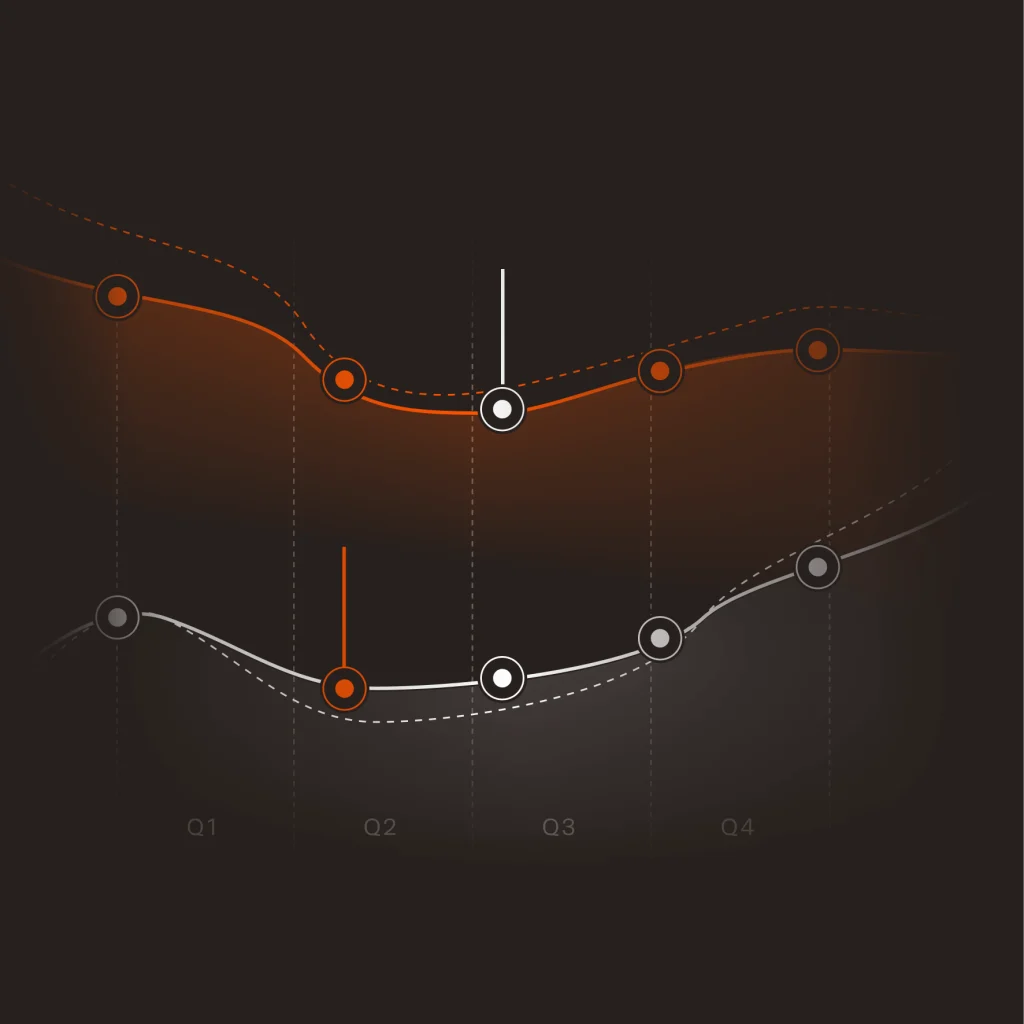

The evidence of maladaptive behavior is clear. According to the Dalbar studies, the average investor underperforms the market by 300 to 600 bps. In 2023, it underperformed by 550. This persistent underperformance stems from poor timing decisions as demonstrated by the fact that funds flows experience the greatest inflows at the top and outflows at the bottom.

Buy Low. Sell High.

Our approach flips the script on investor outcomes by recommending that investors buy low and sell high. By shifting the focus from clock time to market time, we replace being wrong with being approximately right.

The InFlextion Platform eliminates the behavior gap created by considering clock time vs. market time and unlocks smarter decision-making.

The InFlextion Platform

Perfecting Approximation, Not Approximating Perfection.

Our mission is clear. By implementing the InFlextion platform, we can empower investors with actionable insights, and ensure we are providing them with an effective approach to investment success.

Using AI to Excel

InFlextion is an AI-driven investment platform that estimates the probability of improving relative performance and the associated expected relative returns. Traditional methods like asset allocation and risk modelling fail if these estimates are incorrect; InFlextion remains true.

Our platform is the next generation of analysis and probabilistic accuracy.

Precision that

Drives Performance

FlexScore

InFlextion’s data-driven framework evaluates the performance of fund strategies, using a robust three-factor model that estimates the probability of improving returns and expected relative performance allowing wealth managers to make more informed Buy, Hold, or Sell decisions — minimizing guesswork and increasing confidence.

FlexMetrics

InFlextion’s metrics are designed to elevate fund selection beyond traditional rankings. We use our robust scoring methodology to rank mutual funds, assess metrics and generate actionable insights. This guides investors toward funds with the highest promise of future success. InFlextion empowers wealth managers to make informed choices through data-driven, results-oriented strategy.

Connect with us