“Welcome to the Federal Reserve, Mr. Warsh,” Powell might say. “This is TINA—There Is No Alternative. She sets policy. We manage the optics”

When we wrote about real assets last May—and more recently about mining stocks—metals prices surged to record highs before suffering a sharp and historic correction. The prevailing explanation for gold and silver’s sudden selloff is simple: the appointment of Kevin Warsh as the next Chairman of the Federal Reserve.

Warsh arrives with a reputation as a monetary hawk. He talks tough on balance-sheet reduction, spending restraint, and a strong dollar. He argues that lower rates and faster growth need not threaten price stability, echoing a familiar refrain. We heard a version of this story in 2021, when markets were assured that massive fiscal spending wouldn’t ignite inflation.

This time, the optimism is wrapped in an AI narrative. Warsh suggests AI-driven productivity will usher in an era of extraordinary growth so powerful that market-based interest rates can be ignored to finance the next industrial revolution. It’s an attractive vision. It’s also one that runs headlong into the same constraints faced by outgoing Chairman Jerome Powell.

Personnel changes do

not alter macro reality.

Appointing Kevin Warsh does not suddenly transform the United States into a creditor nation capable of servicing nearly $39 trillion in debt while simultaneously funding massive infrastructure investment. It does not repeal balance-of-payments math. America’s overspending must still be financed by foreign savings; full stop.

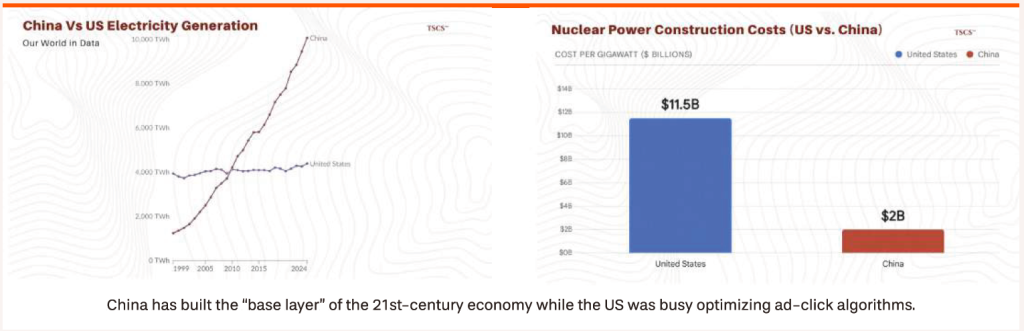

Nor does the AI boom solve the more practical problem of inputs. Over the past decade, the U.S. invested heavily in “attention infrastructure”—apps, platforms, clicks, and content—while China invested in power grids, transmission, and industrial capacity. AI runs on electrons, not engagement.

And rebuilding the physical backbone required for large-scale AI adoption demands capital the federal government doesn’t have at a moment when revenues (even with tariffs) barely cover interest costs and transfer payments.

This is where TINA reasserts herself.

With limited policy options, the Fed is effectively boxed in. Rates must remain low enough to support growth and, critically, to limit the government’s debt-service burden. That combination implies continued pressure on the dollar and a growing need for bond purchases to suppress long-term yields. All roads lead to some form of yield-curve control, the only debate is over how explicit it becomes.

The bond market already understands this. Long-term yields have risen since Warsh’s nomination, not

fallen, signaling skepticism, not confidence.

The bottom line is unavoidable: it will be extraordinarily difficult to simultaneously satisfy bond

investors, protect inflated asset values, run the economy “hot,” and maintain a strong dollar. Something

has to give.

That’s why the recent correction in real assets looks less like a trend reversal and more like a pause. Gold,

commodities, and real-asset equities remain one of the few effective hedges against a policy regime

constrained by debt, demographics, and denial. If the next Fed proves as optimistic about inflation as the

last, real assets are likely to resume their role as both ballast and beneficiary

TINA, after all, is still in charge.

Download the article

Flextion is a breakthrough platform for evaluating fund strategy returns, helping investors identify managers at a pivotal turning point—those poised to outperform after a period of underperformance. Designed by seasoned portfolio managers, Flextion bridges the gap between “clock time” and “market time,” empowering investors to unlock long-term value and uncover hidden performance potential.