John Bogle once observed, “To earn the highest of returns realistically possible, you should invest with simplicity.”

At Flextion, we focus on identifying simple yet powerful investment opportunities— and this month, we’ve found one that stands out.

The Market at Extremes: Valuation, Concentration and Risk

The U.S. stock market is currently at historically high levels of valuation, concentration and performance. The U.S. now comprises over 73% of the MSCI World Index, with Japan—the second-largest weighting— accounting for less than 6%. Within the S&P 500, just five companies control nearly 30% of the index, surpassing the concentration seen in the “Nifty-Fifty” era.

By a composite of valuation metrics—including earnings, book value, sales, Tobin’s Q and total GDP—the S&P 500 recently reached its highest valuation in history. Historically, when markets reach such extremes, they tend to unwind through prolonged periods of low returns or abrupt, painful corrections. The challenge for investors is managing this risk without knowing exactly when or how a market reversion will occur.

A Simple, Smarter Alternative: The Equal-Weighted S&P 500

One of the most effective ways to navigate this risk is also one of the simplest: shifting from the capitalization-weighted S&P 500 index to its equal-weighted counterpart.

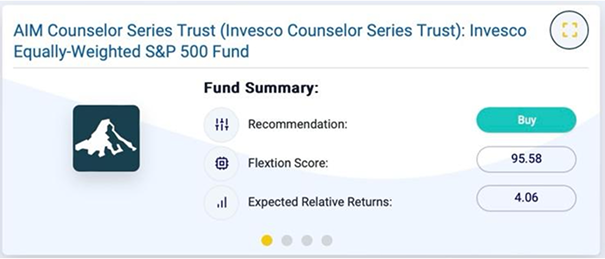

According to Flextion’s proprietary analysis, we estimate a 96% probability that the equalweighted S&P 500 will outperform the capweighted index by approximately 400 basis points annually over the next three years. If the market corrects in the way it did following the 2000 tech bubble, outperformance could approach 1,000 basis points.

Historically, when triggered by Flextion’s buy signals, the equal-weighted S&P 500 has outperformed the cap-weighted benchmark by an average of 425 basis points annually—a meaningful edge in any investment environment.

Why the Equal-Weighted Approach Wins

Shifting to an equal-weighted strategy offers key advantages:

Better Valuation

Reduces exposure to the most overvalued stocks and provides a more balanced allocation.

Stronger Fundamentals

Improves dividend yield and enhances exposure to smaller, more reasonably priced companies.

Enhanced Diversification

Lowers reliance on the largest mega-cap stocks, reducing concentration risk.

Higher Return Potential

Historically, an equal-weighted approach has generated superior long-term returns, particularly in market environments like today’s.

This simple, low-cost shift allows investors to enhance performance, reduce risk and improve diversification—without sacrificing exposure to the long-term potential of U.S. equities.

An Investment Move Even Jack Bogle Would Appreciate

Current market dynamics present a compelling case for investors to reconsider their S&P 500 exposure. The equal-weighted index provides a straightforward, effective way to mitigate risk while unlocking potential outperformance. In an environment where complexity often leads to underperformance, simplicity remains a powerful advantage. This strategy embodies the philosophy of prudent, intelligent investing—one that even Jack Bogle would likely endorse.

Download the article

Flextion is a breakthrough platform for evaluating fund strategy returns, helping investors identify managers at a pivotal turning point—those poised to outperform after a period of underperformance. Designed by seasoned portfolio managers, Flextion bridges the gap between “clock time” and “market time,” empowering investors to unlock long-term value and uncover hidden performance potential.